Re-watch & re-cap: Open Banking Forum 19/03/21

Joe Roche / 19th March 2021

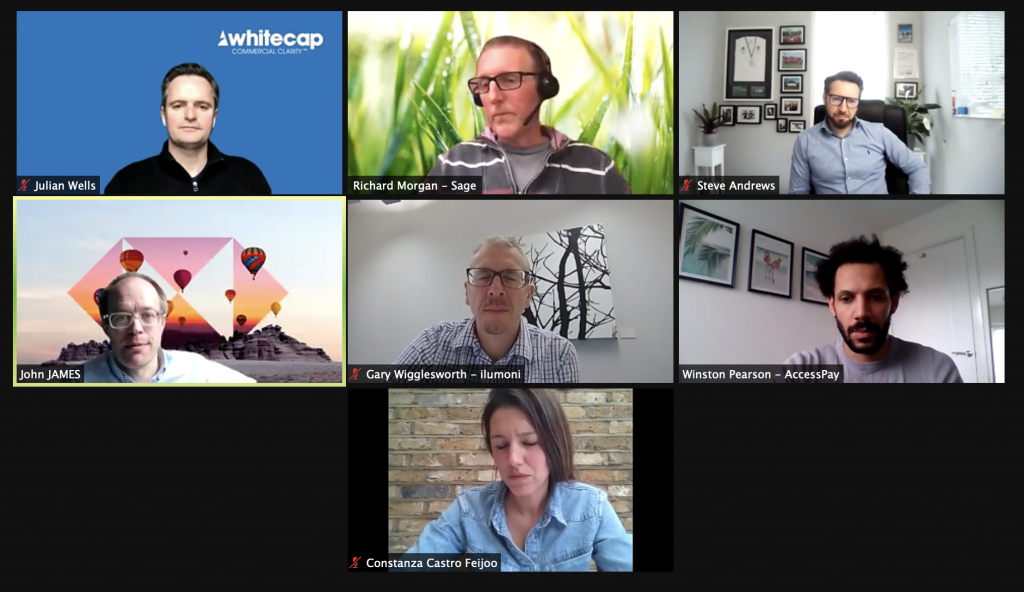

On the 19th March the FinTech North community came together virtually to discuss Open Banking.

For those who couldn’t join the event live, we have produced a recording and a write-up so you can catch up. Click the image below to view the recording.

Joe Roche, Engagement Manager at FinTech North, welcomed attendees to the event and explained about the work FinTech North do in the Northern FinTech ecosystem. Joe also highlighted recent International Opportunities for Northern FinTechs, as well as highlighting FinTech North’s partnership with Open Banking Expo – The largest global community for ideas, connections and deals in Open Banking and Open Finance.

Our first speaker was Constanza Castro Feijóo, Stakeholder Engagement Specialist at Open Banking Implementation Entity (OBIE). Connie explained who the OBIE are and the work they do creating software standards and industry guidelines that drive competition and innovation in UK retail banking.

Connie provided some great stats and an overview of Open Banking adoption:

o +750 companies registered with the OBIE and enrolled in their sandbox

o +708 million open banking API calls every month

o +3.01 million consumers using open banking

Connie explained about the creation of the open banking North of England cluster, which is an open working group to collaborate on open banking initiatives. Connie gave us an idea of the future opportunities in open banking as OBIE see them:

o Variable recurring payments

o Extending into broader Finance sectors

o Extending into other sectors

o What’s next is up to us! The future governance of open banking is being discussed right now. The CMA is holding a consultation. We encourage all stakeholders to participate. Submit your thoughts at: https://lnkd.in/eVZQxNp

Matt Hanna, Head of Business Transformation at Newcastle Strategic Solutions, was our next speaker. NSS specialise in building savings platforms for customers. Matt provided a savings perspective on what Open Banking means for savings.

According to PwC, 2/3rds of UK adults will have adopted Open Banking by 2022. Matt identified opportunities among two demographics within savings; Accidental Savers & Non savers

“Open Banking has the potential to transform how we save our money” – Matt Hanna, Head of Business Transformation, Newcastle Strategic Solutions

Next up was Winston Pearson, Senior Product Manager at AccessPay. Winston provided a corporate perspective from his work at AccessPay. Winston talked through Open Banking; highlighting that Open Banking doesn’t quite come with the same benefits.

Winston then talked us through the customer journey as AccessPay see it.

“The introduction of bulk payments has really helped the Corporate use cases, but there is still too much friction” – Winston Pearson, Senior Product Manager, AccessPay

Winston said there is light at the end of the tunnel with variable recurring payments. The potential for corporates here is huge. Winston also talked about the data flow back into the corporates.

“For the corporate, this not only reduces the friction and expense, it’s also made the data flow immediate” – Winston Pearson, Senior Product Manager, AccessPay

Gary Wigglesworth, CEO of ilumoni, was our next speaker. ilumoni are a Barnsley based FinTech aiming to help people borrow well. Gary provided a consumer perspective.

ilumoni help reconstruct a consumer’s borrowing balance sheet. For ilumoni, Open Banking is all about liberating data.

“Banks and credit card companies have been sending users data for years and years, bank statements don’t get opened or go straight into the drawer, consumers have not been using that data.” – Gary Wigglesworth, CEO, ilumoni

Richard Morgan, Principal Architect at Sage, provided a technology perspective from Sage’s view point as an industrial scale payroll processor. Richard explained that Sage have software products focussed on accounting, finances, people and payroll. Within the context of Open Banking, Sage have numerous key use cases from their customers.

Richard spoke about integration approaches; the most obvious approach being to go directly to the banks using the Open Banking standards. Another route is to go via a provider. So far, Sage’s integrations have been mainly via providers.

Richard highlighted some Technical observations including payments having 14 different API’s and Common Authorisation Flow.

Open Banking Challenges:

- Initial B2C focus

- Bulk/batch payments lacks maturity

- Variable recurring payments – future

- Trusted beneficiaries?

Notes re User Experience:

- 90 day re-authorisation painful

- Best experience through app to app redirection

- Biometric authentication

- Possession based authentication

- Limited/no decoupled authorisation

“In summary, there’s some excellent technology there, it’s still early days and we’re excited to make use of it to create great experiences for our customers” – Richard Morgan, Principal Architect, Sage

We then gathered our speakers together for a panel discussion. We were joined by John James, Head of First Direct Digital Product and Steve Andrews, Head of Sales at BrightBox Group.

Click here to watch the recording.

As mentioned by Joe, FinTech North has put together a series of partnership packages for organisations who are able to support our work in the Northern FinTech ecosystem. You can read more about that here. Our partnerships start from £500 per annum and all of our partners feature on our partners page. For more information on our partnerships, please contact our Engagement Manager Joe (joe@fintechnorth.uk)