North-East FinTech Forum: Re-cap

FinTech North / 29th March 2023

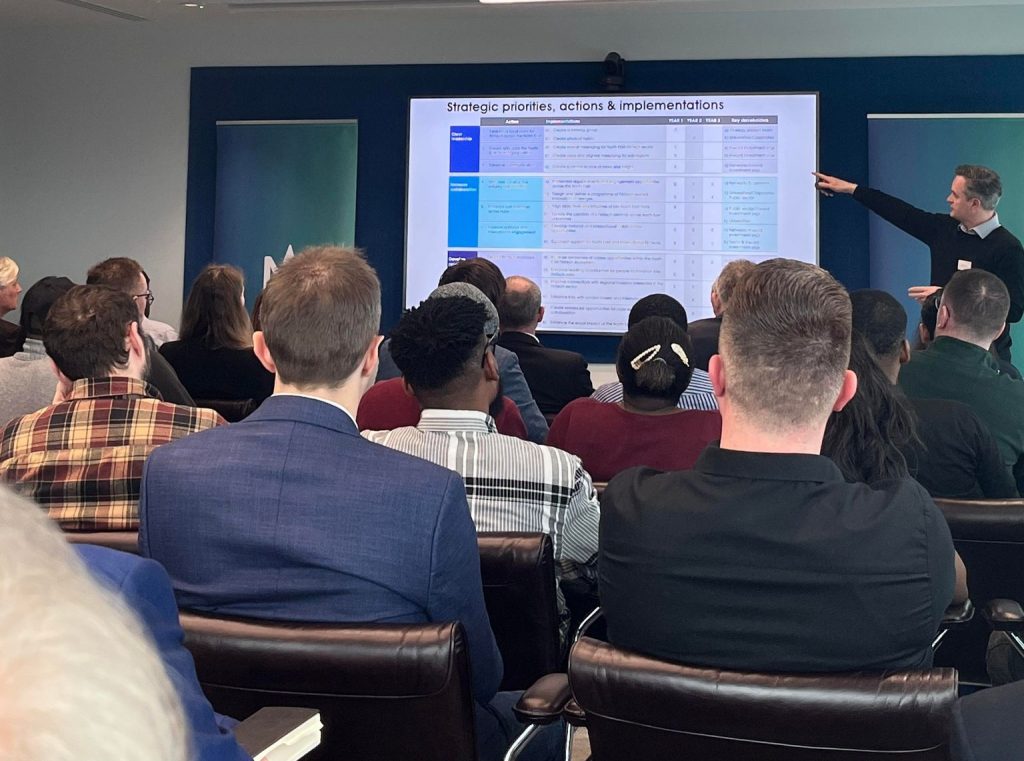

On Wednesday 29th of March, FinTech North welcomed over 70 delegates to Womble Bond Dickinson‘s beautiful offices in Central Newcastle for our North-East FinTech Forum.

Of what is becoming standard at our North-East based events, the North-East FinTech Forum laid claim to a room full of passionate delegates from the FinTech community in the region. The turn-out and engagement throughout is evident of the real appetite for growth and development of the FinTech sector in the North East.

The event was hosted in partnership with Womble Bond Dickinson, Innovation SuperNetwork and North of Tyne Combined Authority.

For those unable to make the event on the day, FinTech North is delighted to share a write-up to re-cap on.

Joe Roche, Engagement Manager of FinTech North welcomed delegates to the event, before promptly passing over to Caroline Churchill, Partner of event partners and hosts, Womble Bond Dickinson, who welcomed attendees, briefly introduced the transatlantic law firm and emphasised the intricate role regulation has to play when dealing with Tech and Data enabled companies.

Joe Roche then introduced our organisation; provided an overview of our objectives, impact in the sector and our recent events, before highlighting our marketplace, in partnership with NayaOne, designed for Northern FinTechs to showcase their capabilities, access datasets and test ideas.

Our first speaker of the day was Julian Wells, Director of Whitecap Consulting & FinTech North, who began by providing both a national and regional FinTech update. Most notably, touching on the recent launch of the Centre for Finance, Innovation and Technology (CFIT) in Leeds – outlining it’s commitment to supporting regional FinTech hubs, including the North East.

Julian continued, and revisited and recapped on the North East FinTech Strategy report 2022-2025, created by Whitecap Consulting and supported by a number of key stakeholders in the ecosystem – a publication developed on the back of the Kalifa Review, which recommended that each regional cluster should develop a 3-year FinTech strategy.

He outlined the positive growth of the FinTech ecosystem in the North-East across the board and how it has evolved in the past three years, before sharing an overview and the purpose, objectives and goals of the North East FinTech Strategy. Three strategic priorities became apparent, including ‘Clear Leadership’, ‘Increase collaboration’ and ‘develop resources.’

Since the launch event back in October, a North East FinTech steering group was formed and now meets monthly to ensure steps are being taken to execute the strategic priorities laid out in the Strategy report.

“It’s great to have this initiative set up, but an issue we faced was – who is going to take control?”

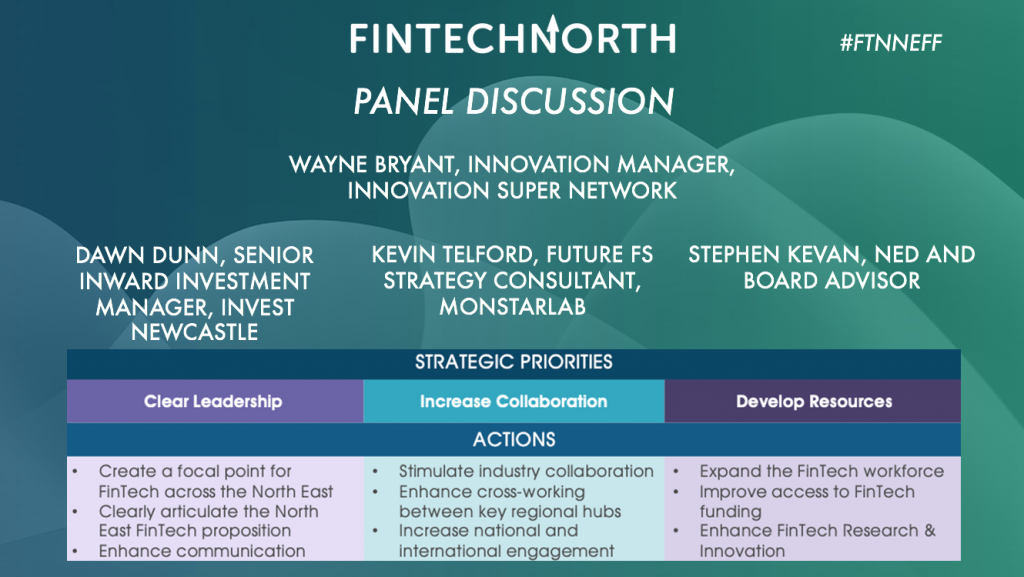

This segued nicely into the event’s next segment. Julian introduced our panel members and leaders of each sub-group that focused on the aforementioned strategic priorities; Dawn Dunn, Senior Inward Investment Manager at Invest Newcastle, who aligned to ‘Clear Leadership’; Kevin Telford, Future FS Strategy Consultant at MonstarLab, who aligned to ‘Increase Collaboration’ and Stephen Kevan, NED and Board Advisor, who aligned to ‘Develop resources’. We were also joined by Wayne Bryant, Innovation Manager at Innovation Super Network, who acts as the secretariat role for the Steering group.

Whilst there is huge overlap between the key strategic priorities, it was great to hear from each panel member, who are spearheading the momentum of each; leading discussion and outlining action points.

CLEAR LEADERSHIP – Dawn Dunn, Senior Inward Investment Manager, Invest Newcastle

“Putting collaboration at the heart of everything is key to future success.”

“We need clear branding and communication.”

“We are hoping to commission a feasibility study to help understand what business needs from our leadership and how that can help them achieve their commercial objective. From the outside of the region, we need a beacon – a place to direct enquiries and ask questions and collaborate”

“That focal point might look like a physical hub, an online presence and an outreach programme of events and activities – people need to be aware of the momentum. There needs to be a landing spot”

INCREASE COLLABORATION – Kevin Telford, Future FS Strategy Consultant, MonstarLab

“I want to see the NE succeed – how can we make innovation faster to market and encourage entrepreneurs to grow here?”

“We’ve outlined a mission, and purpose framework so that there is clear idea and message across the board. What are the problems we face? Lack of entrepreneurs, skills and a talent gap – these are the challenges we need to overcome.”

“How can we address problem statements in society, FS, the environment? Consented data. We can then build projects, utilising several use cases, which flows into an innovation hub of financial input, an investment platform, spin this into the universities, build proof of concepts and MVP, then look for sponsors – this is the foreseeable future into real impact.”

“It’s all about what we’ve heard in the region and how we can impact this!”

DEVELOP RESOURCES – STEPHEN KEVAN, NED AND BOARD ADVISOR

Stephen agrees with Kevin – “This will create new businesses, jobs and opportunities for students to be involved.”

“We found that there’s an awful lot going on around the North East anyway – for example, the Tech Talent Engine and the highly ambitious One Digital Collective – how can we work with them? Learning establishments – the ability to re-skill, up-skill, take your own staff and progress them is very strong. Our role in the FinTech space is to identify those and bring them to the forefront. If we know our objectives, let’s utilise what is out there and collaborate all of them together as part of the strategy.”

“However, the North East is not advanced in funding – we want to demonstrate a model of taking problems and creating solutions. This can lead to commercial opportunities, which leads to further funding and investment interest.

“We want to do a FinTech Funding Forum – but we need the story first – our own proof of concept as a cluster. Then we can attract not just regional interest, but national and international finance – we’re talking to the middle-east, Singapore etc.

James Thwaites, Associate Director of Whitecap Consulting played a key role in the Strategy publication and delivery. He adds, “Now is the time to formalise what this body can engage with formally in the sector. People know what we’ve (the North-East) been famous for in FinTech, but what are we going to be famous for in the future?”

The panel welcomed questions and observations from the audience, covering themes such as; FinTech in Universities, data, access to talent, impact of CFIT and collaboration.

Impact of CFIT

DD: “Hopefully support entrepreneurs through the work in the regulatory sandbox – try out ideas in a safe environment and sped up that to market. It’s something that will develop as people engage with it.”

KT: “I see it as a virtual knowledge bank. A way you can see your ideas, connect and grow.”

Julian then thanked the panel members for their contribution and their work and passion for developing the FinTech sector in North-East.

Our final segment of the day was our North-East FinTech showcase, featuring some of the exciting North-East based FinTechs who joined us to share their innovation propositions.

Intercash – Lucy Mounter, Senior Business Development Executive

Sportfin – Siddesh Iyer, Founder and CEO

SPARK EPOS – Eric Guo, Founder

Settld – Vicky Wilson, Founder and CEO

Joe Roche and Julian Wells then brought the event to a close, inviting guests for some final networking.

The North-East FinTech Forum was hosted in partnership with Womble Bond Dickinson, Innovation SuperNetwork and North of Tyne Combined Authority.