FinTech North – 2020 reflections, plans for 2021 and beyond

Joe Roche / 4th December 2020

2020 has been a year of challenge and change for many organisations, with FinTech North being no exception. We would like to provide an update on our future plans and how we intend to evolve our proposition and enhance how we serve the northern FinTech community.

FinTech North’s purpose & objectives

FinTech North has a long standing and clearly defined purpose, objectives and values, which we have remained true to throughout the challenges of 2020:

FinTech North – the story so far

FinTech North was the first regional FinTech ecosystem body in the UK. Since our creation in April 2016 as a one day event, FinTech North has become an ecosystem facilitator which helps build the FinTech community across the ‘Northern Powerhouse’. We have a unique role not only because of our regional focus but because we are not aligned to a particular city or region, operating instead across the north and collaborating rather than competing with other FinTech and tech groups. FinTech North is also strongly aligned with FinTech nationally and is part of the FinTech National Network, ensuring we are able to feed in the views of our community into the national policy agenda.

FinTech North has always strived to be inclusive in every way, including: catering a wide audience defined as anyone with an interest in FinTech; offering an accessible platform for emerging FinTechs to speak at; and making almost all events free of charge for anyone to attend. Over the last four and a half years this approach has helped us build an engaged and supportive community. A survey in August 2020 revealed a Net Promoter Score of 42, which is comparable to the likes of Apple and Microsoft. By the end of 2020 we will have hosted nearly 70 events across the north, the most recent of which have of course been webinars, opening up an even wider audience. You can see the results of our community survey here.

All our activity to date has been funded by sponsorship, and our success with seminars and conferences meant that in 2019 we were able to hire our first dedicated full time employee in Joe Roche, our Engagement Manager. Prior to Joe joining, FinTech North was operated via the efforts of our co-founders, Whitecap Consulting and White Label Crowdfunding, with support and goodwill from various organisations providing venues, catering and sponsorship. We have also enjoyed the unwavering support of our Chairman, Chris Sier, the HM Treasury FinTech Envoy to the Northern Powerhouse and a long-time supporter of regional FinTech across the UK.

The impact of Covid

Covid-19 has highlighted the weakness of FinTech North’s funding / commercial model, challenging its viability at a time when the north’s opportunity in FinTech continues to grow. Our 2020 revenues will likely finish on around 25% of the level achieved in 2019, and like many organisations we have been grateful for the furlough scheme. As a Leeds-based organisation we were also grateful for the support of Leeds City Council at the height of the first wave of Covid. This support has helped us survive Covid.

Moving forward we need to find a new way of working and funding our activity, as event sponsorship alone is not sufficient, albeit we have been able to deliver a number of webinar events with sponsorship from organisations within our community including Equiniti, Marqeta, Squire Patton Boggs, MBA, Netpremacy, RSM, and others.

Future plans

We don’t just want FinTech North to survive and be viable, we want it to thrive and make even more of a positive impact on the development of FinTech in the north and the UK as a whole. But in the immediate term, we need to ensure we can continue to fund the delivery of our activities such as events (virtual or physical), marketing and promotion, and our engagement with the wider UK ecosystem.

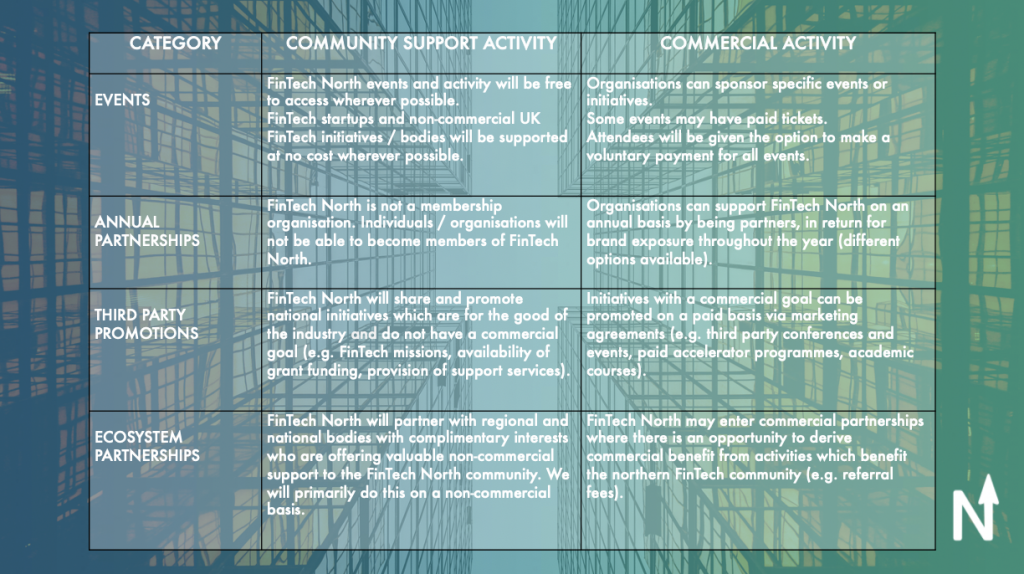

We envisage our future funding will come from a wider range of commercial activity, and having reviewed our options we have identified four primary routes:

- Enhanced event sponsorship options.

- The option for organisations to be annual ‘supporters’ of FinTech North.

- An increased focus on relevant third party promotions.

- Implementing commercial partnerships that meet certain conditions.

Some really important things won’t change. FinTech North will continue to exist for the benefit of the northern FinTech community (‘FinTech Northerners’) and this will continue to be the primary purpose of the organisation. FinTech North’s events will continue to be accessible to all and free to attend, although we have recently added a voluntary donation option to our Eventbrite booking pages.

We have summarised our approach below:

For 2021 we are offering organisations the opportunity to publicly show their support for FinTech North by becoming partners, in return for brand association and other benefits such as having their logo and partnership status published on the FinTech North website and at all events. Partnership options start from just £500 per year, please contact Joe Roche for more information.

Additionally, in 2021 we intend to enhance how we operate by appointing a small group of advisory board members and regional representatives across the regions of the north. These positions will be voluntary and on fixed term of one year, with the aim of ensuring we remain well connected to developments across the north.

All of the above changes are considered to be an extension of ‘business as usual’ at FinTech North, with the goal of enhancing what we offer whilst also generating revenues to help run the business. If successful this will enable us to address things such as enhancing our marketing materials; creating new video content; developing event streaming capability for ‘hybrid’ events; PR and promotional activity; hiring an administrator / support team member; embarking on a programme of thought leadership and partner marketing; and of course developing a more comprehensive events programme catering for specialist areas of interest.

We have also identified how we could accelerate the growth of the business and expand into other areas. For example we aspire to set up a FinTech training programme; to establish FinTech internship programme; to champion the ecosystem via FinTech North Awards; to launch a funding portal; and to help facilitate the matching of supply and demand of skills and talent across the north. This all forms part of our longer term thinking over the next three years, and we will be considering how best to fund such future developments if we decide to progress with them.

As part of this consideration, we will also explore public sector funding. It is possible that our strong alignment with the national FinTech agenda and northern economic growth plans may open up grant funding opportunities to act as a catalyst for the growth of the business. There is currently a review of UK FinTech underway which (amongst other things) is assessing how the national FinTech sector can be best supported. This may open up some interesting opportunities for FinTech North and other regional FinTech groups across the UK.

What does this mean for you?

For the 4000+ members of the FinTech North community, our future plans simply mean that you can continue to participate and benefit from FinTech North’s activities in the same way you always have done. For potential sponsors and commercial partners, we now have more ways to engage with you, and we’d love to hear from you at info@fintechnorth.uk

Finally, we would like to thank everyone who has supported FinTech North on our journey so far, including speakers, sponsors, event hosts and partners, or simply by attending our events or sharing our social media posts. We are grateful to each and every one of you – thank you for being FinTech Northerners.

The FinTech North team

Chris Sier – HM Treasury FinTech Envoy & Chairman of FinTech North:

“It has been a pleasure to be involved in FinTech North since speaking at its very first event back in 2016. Since that time FinTech North has delivered great value to many people and organisations across the regional, national and indeed international FinTech sector via its events, communications, introductions and other activities. It is important that the north continues to benefit from FinTech North’s ongoing development and equally it is important that the north continues to support FinTech North.”

Dawn Dunn, Cluster Manager, Dynamo North East:

“Operating through the Dynamo technology network, the north east represents the only regional body with a specific focus on Fintech. Collaboration with FinTech North gave us a platform for even greater reach across the north through their events programme, and we look forward to discussing plans for closer working and more collaboration in 2021”

Eve Roodhouse, Chief Officer, Culture and Economy, Leeds City Council:

“We see the digital sector as a crucial element of the economy in Leeds, and FinTech is one of the key sectors for this region. We have worked closely with FinTech North over recent years and it is a valued partner to Leeds City Council not just locally, but also via its connectivity across the northern, national and international FinTech sector.”

Alice Lamb, Head of Investment Services at Growth Platform – the Liverpool City Region Growth Company:

“Liverpool has strong heritage in the financial services and we have actively engaged with the FinTech sector over recent years, including working with FinTech North on a number of events and international trade missions. FinTech North has helped raise the profile of FinTech across the north and further afield and we look forward to continuing to work with the team over the coming months and years.”

Rachel Eyre, Business Development Manager, Financial and Business Services, MIDAS:

“Being home to the UK’s largest regional banking and financial services industry as well as one of Europe’s largest digital and technology clusters, Manchester has developed a strong reputation as the FinTech capital of the North and earlier this year the city was recognised as the largest regional FinTech ecosystem in the UK. FinTech North have played a valuable role in the progression of the industry – not just in Manchester and the North but nationally and internationally – and I look forward to continuing our partnership in line with their future plans.”

Peter Cunnane, Head of National and International Strategy, Innovate Finance:

“We continue to work in collaboration with FinTech North on several priority areas that will hopefully have a positive impact on businesses across the North of England. Whether it is through improved access to growth capital, enhanced international competitiveness, or working towards a greater national connectivity through the forthcoming Kalifa Review, we see opportunities to strengthen the national ecosystem that will enable FinTech companies to scale. Working in partnership with all our FinTech National Network partners means we can collectively realise these vital opportunities.”

Phil Vidler, CEO, FinTech Alliance:

“As a vital part of the UK FinTech ecosystem, it’s encouraging to see the growth FinTech North has achieved since its foundation just a few years ago. 2020 has been an uncertain and confusing time for businesses, but the team have provided vital support for the northern FinTech ecosystem. Their knowledge and understanding has helped the community navigate the many challenges faced. This will be even more important as the sector recovers and continues on its growth trajectory next year. The FinTech Alliance team are proud to have worked with FinTech North in a partnership that has been eye opening and mutually supportive, and we look forward to strengthening this relationship as we head into 2021.”

FinTech North in lockdown:

- Covid-19 FinTech Industry Support Resource Page

- FinTech North Community Survey

- FinTech North Community Survey Results

Virtual Events (click to re-watch or read the write-up):

- Emerging Vulnerability Webinar, in partnership with Equiniti Credit Services

- How Google supports FinTechs, in partnership with Netpremacy

- The Role of FinTech in Business Debt, in partnership with Leeds City Council

- The Role of FinTech in Personal Debt, in partnership with Leeds City Council

- Machine Learning & Smart Analytics, in partnership with Netpremacy

- Increasing Resilience in FinTech, in partnership with RSM UK

- Virtual FinTech Mission, in support of MIDAS Virtual Manchester FinTech Mission

- Open Mic FinTech Showcase, in partnership with Netpremacy as part of Leeds Digital Festival

- Blockchain Forum, in partnership with Squire Patton Boggs

- Virtual Manchester Conference, in partnership with Marqeta

- The Future of Savings, in partnership with Raisin, Mutual Vision and Newcastle Strategic Solutions

- Future of FinTech Talent & Skills, in partnership with MBA