Event Round-up: North East FinTech Ecosystem Research Launch

Joe Roche / 29th November 2019

On Thursday 28th November we hosted a FinTech North breakfast seminar to unveil the results of Whitecap’s recent research into the North East FinTech sector. Tasmin Lockwood, a journalist with The Northern Report, wrote the event up and we’re delighted to share it:

Whitecap Consulting today gave the North East a first look at its report into the region’s financial technology sector during an event hosted by FinTech North at Newcastle University.

The North East FinTech Ecosystem research, supported by organisations across the North East such as Dynamo North East and FinTech North, gave mention to the region’s successes while making significant recommendations on how to grow and nurture the sector.

The research analyses the current state of FinTech in the North East, highlighting areas of strength and identifying opportunities for development.

Julian Wells, director of FinTech North and Whitecap Consulting, told The Northern Report: “This type of regional insight is crucial in helping people both inside the region, and nationally and internationally, to understand what Newcastle has to offer, and hopefully will attract more investment into the region.”

Held in the National Innovation Centre for Data at The Catalyst building, part of the new Newcastle Helix development which brings together public, private and academic sectors, Wells began by defining FinTech.

“The use of technology to improve financial products or services,” he said. The research categorises 56 companies in the North East as such, which are also directly involved in the sector, with a somewhat even spread across startups and scaleups (30%), established financial services and FinTech firms (34%) and tech firms operating in the financial sector (36%).

In the final version of the report, the number is expected to be around 60.

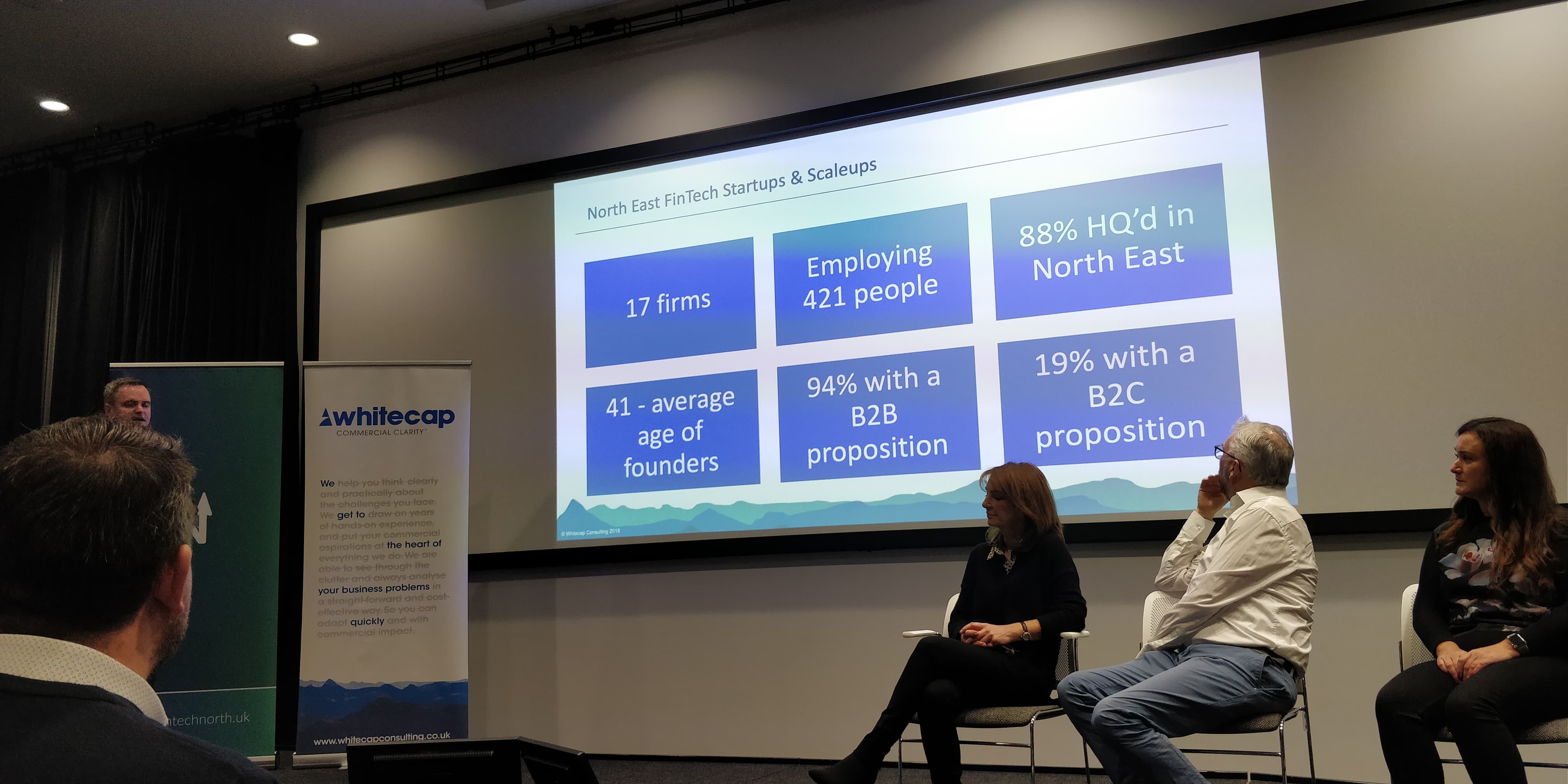

Startups and scaleups

Though lacking unicorns, the region is home to a vibrant startup scene, which the research acknowledges. There are 17 FinTech startups and scaleups, employing 421 people. Of which, 94% have a B2B proposition, compared to 19% for B2C, though some offer both (hence the number surpassing 100%).

The average age of a founder in this space is 41 years old, showing how the ‘move fast and break things’ ethos does not apply to the region, where businesses are built with experience to back them.

And while the North East can celebrate the birth of its own FinTechs, with 88% headquartered in the region, the remaining 12% have made it their second home. This emerging trend, where startups and scaleups look for a second region instead of expanding in their home city, presents a great opportunity.

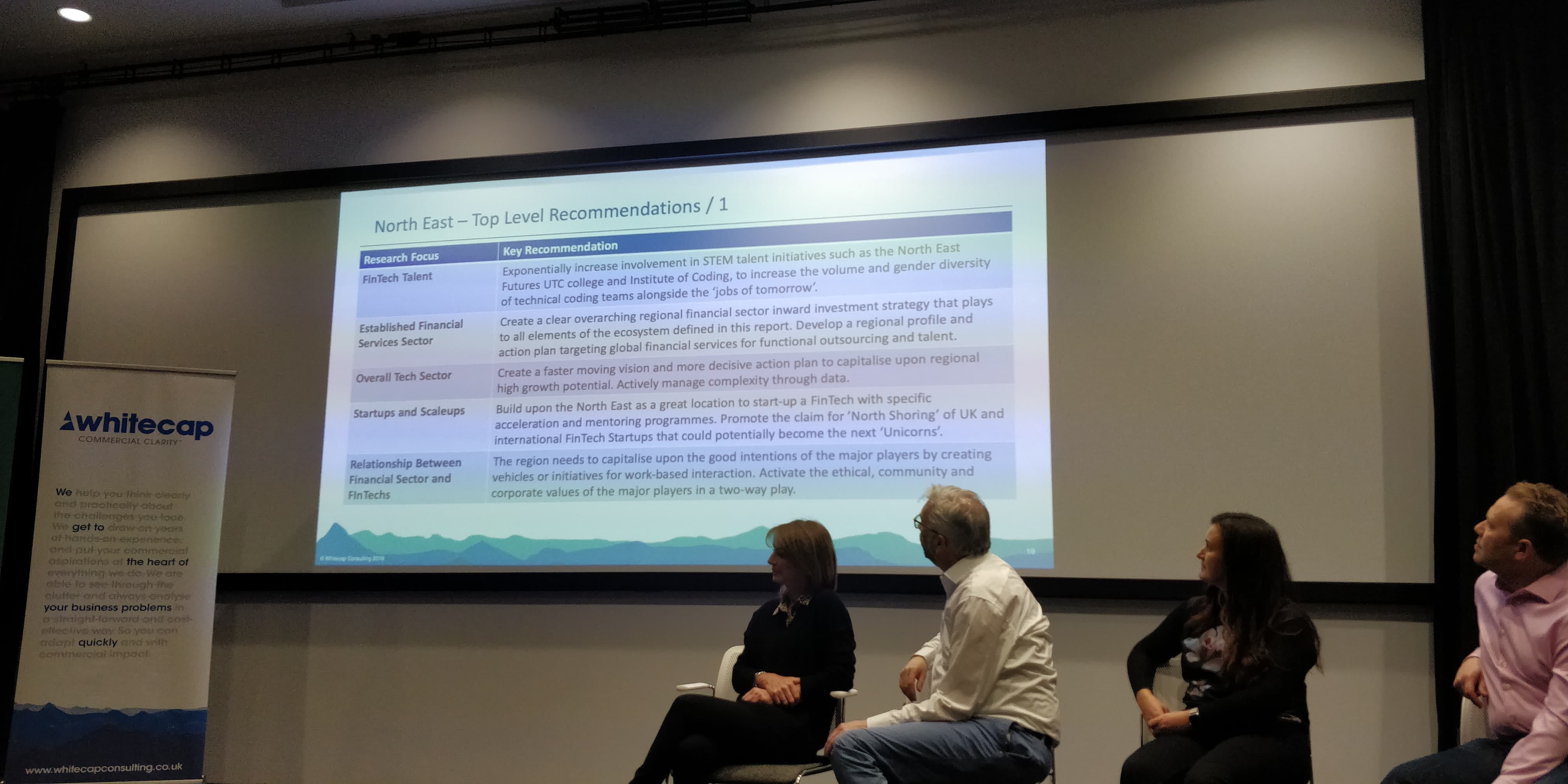

Highlights and recommendations

While the region should no doubt be proud it’s home to Sage, the UK’s largest listed tech company; Atom Bank, which raised £450m in funding over the past three years; and that it’s well represented within Tech Nation’s lastest FinTech cohort, there is certainly more to be done.

Home of two new research centres, the National Innovation Centre for Data and the National Innovation Centre for Ageing, and geographically a “tech corridor” between Manchester and Edinburgh, the North East must establish a strong, actionable strategy to ensure opportunities are not missed.

The region is also the only one in the North to have a dedicated FinTech cluster, a working group dedicated to encouraging collaboration within the ecosystem, led by Dawn Dunn from Dynamo North East.

Speaking to The Northern Report, she said: “The North East is in a really unique position at the moment. It’s time to take our seat at the table. We have a lot of advantages, not least the low cost of business, which is very important to companies looking to establish a second office or startup in general.”

Progress centres around attracting more skills into the region, with the biggest problem being the lack of big data and analytics talent, or “bringing the Geordies home”.

Lindsay Phillips, executive vice president for product delivery at Sage, said at the event: “The report is a great start but what must we do to put this in motion? How do we create this growth? Without increased capacity in the region, we are all competing for talent.”

Collaboration between public and private sectors, as well as different sized companies, comes strongly recommended. One way to do this would be through tailored university courses, greater placement options, and inward investment in STEM initiatives aimed at encouraging graduates to stay in the region.

Ecosystem clustering is essential but this must be supported by an independent public and private strategy and implementation group, the research suggests, and a working group alongside universities to “join up the dots” within the region’s FinTech sector.

Findings are not new, so what’s next?

Dunn said: “The recommendations are all points that people are aware of but no one has actually said out loud. We need to implement a strategy to follow the suggestions in the report.”

The event gave only a top-level summary of recommendations but Wells promises the full report looks at each point in-depth, having been based on interviews with FinTech companies across the region.

FinTech North has also been working with government bodies such as the Financial Conduct Authority (FCA), Department for International Trade (DIT) and the Treasury in its efforts for North East recognition. The latter of which, according to Wells, is interested in what it needs to do to help. Although its FinTech envoy strategy covers the Northern Powerhouse, there is currently no envoy based specifically in the North East region.

Suggestions are not unique to FinTech, but can be applied across all technology sectors to ensure growth.

An audience member also suggested the North East would benefit from greater links to other financial hubs around the world. While London, Dublin and Dubai are easily accessible, it would be beneficial to have a direct link to Frankfurt, for example.

Wells told The Northern Report: “The North’s FinTech community is more joined-up than many other sectors of the economy.

“FinTech North, for example, deliberately focuses on the North as a whole region, rather than focusing on the individual cities as component parts. It’s this level of collaboration and cohesion that has really elevated the North to its current position of economic strength. If the North of England was a country, it would be the ninth biggest economy in Europe. It’s perhaps because of this that our Northern regions are pulling in more international investment into FinTech than ever before.

“The research will also be a valuable resource for wider governmental and regulatory organisations. FinTech is a high growth sector, and the UK is a global FinTech hub, so there’s a lot of national interest in terms of economic growth. As such, there’s an increasing amount of focus from organisations like the Treasury, the Department for International Trade and the Financial Conduct Authority, as they aim to better understand the national FinTech picture and activity in the regions.”

Whitecap is currently conducting a similar exercise in four other regions in the UK. The North East FinTech Ecosystem research will be released in December.